|

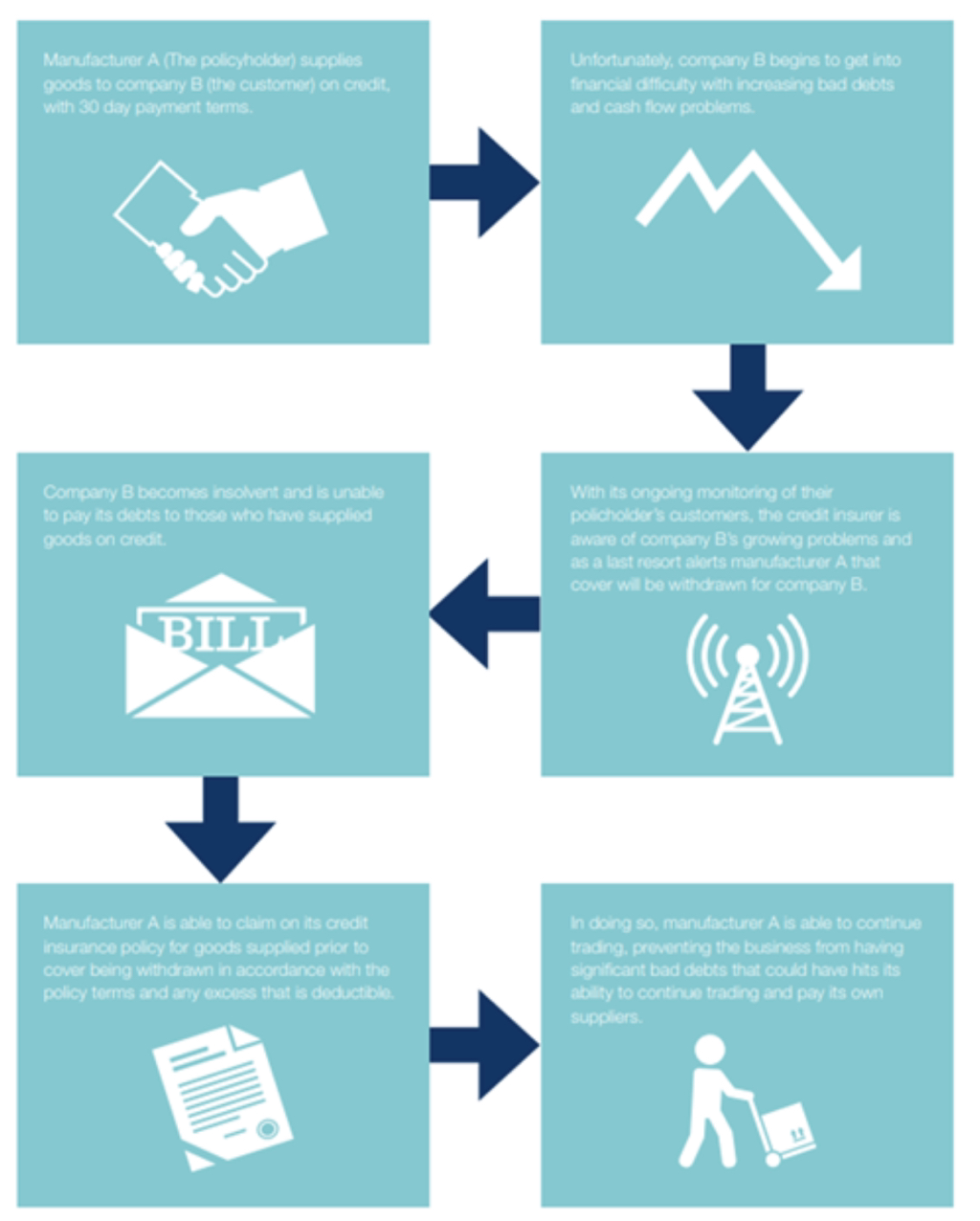

Trade credit insurance – is also know as accounts receivable insurance – this special type of insurance product protects businesses when a customer fails to pay a trade debt.

ACCORDING TO ALLIANZ 40% OF MANY BUSINESSES ASSETS ARE UNPAID INVOICES ! Have you sat down to figure out how much your company has in unpaid invoices? How many invoices a year does your business have go unpaid or do you only receive a partial payment on? If these numbers are high as a % of total sales or cumulatively accumulating to several thousand a year or more then maybe trade line insurance might help you, however unless you have significant losses due to unpaid invoices it may not be worth the cost of trade line insurance. .WHAT IS THE POTENTIAL COST OF TRADELINE INSURANCE? According to Allianz there are many factors that will effect your rate of cost such as industry you are in, and who your customers are . It’s important to note trade line insurance is for business to business situations and not for company’s that sell direct to consumer . However Allianz says in most cases the trade line insurance is a cost of less then one quarter of one percent , this means to insure payment on 20 million a year in business to business invoices would only be $50,000 per year , which for many is a bargain for the piece of mind it gives , however others may decide to risk it and pocket the $50,000 they would have spent on trade line insurance and buy a used porch boxer with it . TRADE LINE INSURANCE COMES WITH POLICY AND PROCEDURES TO REDUCE UNPAID INVOICES In order to receive trade line insurance if not already implemented your business will have to use industry standard practices to reduce default , these practices allow trade-line insurance to exist economically while simultaneously reducing your need for it, through a reduction of defaults due to the policies that your trade line insurance company will advise you to take and most likely require you to take. article written by Adam Cox for Cox Business News

0 Comments

Leave a Reply. |

Cox Business News staff WriterJournalists from around the world writing to give you answers, with Assitant Editor Dr Muhammad Hassan Fayyaz for articles in June and July 2021 The Editor In Chief of Cox Business News

|

RSS Feed

RSS Feed