|

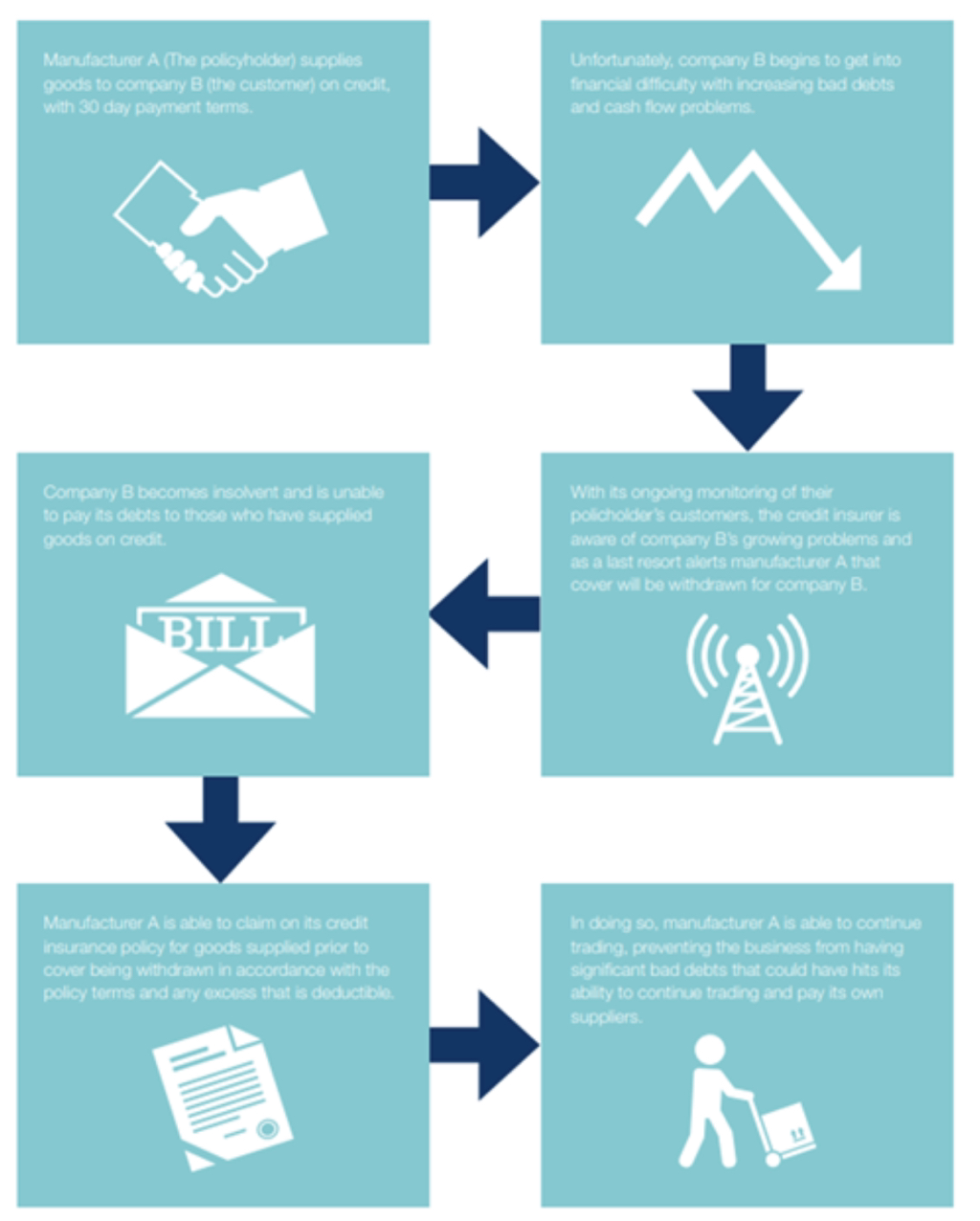

Trade credit insurance – is also know as accounts receivable insurance – this special type of insurance product protects businesses when a customer fails to pay a trade debt.

ACCORDING TO ALLIANZ 40% OF MANY BUSINESSES ASSETS ARE UNPAID INVOICES ! Have you sat down to figure out how much your company has in unpaid invoices? How many invoices a year does your business have go unpaid or do you only receive a partial payment on? If these numbers are high as a % of total sales or cumulatively accumulating to several thousand a year or more then maybe trade line insurance might help you, however unless you have significant losses due to unpaid invoices it may not be worth the cost of trade line insurance. .WHAT IS THE POTENTIAL COST OF TRADELINE INSURANCE? According to Allianz there are many factors that will effect your rate of cost such as industry you are in, and who your customers are . It’s important to note trade line insurance is for business to business situations and not for company’s that sell direct to consumer . However Allianz says in most cases the trade line insurance is a cost of less then one quarter of one percent , this means to insure payment on 20 million a year in business to business invoices would only be $50,000 per year , which for many is a bargain for the piece of mind it gives , however others may decide to risk it and pocket the $50,000 they would have spent on trade line insurance and buy a used porch boxer with it . TRADE LINE INSURANCE COMES WITH POLICY AND PROCEDURES TO REDUCE UNPAID INVOICES In order to receive trade line insurance if not already implemented your business will have to use industry standard practices to reduce default , these practices allow trade-line insurance to exist economically while simultaneously reducing your need for it, through a reduction of defaults due to the policies that your trade line insurance company will advise you to take and most likely require you to take. article written by Adam Cox for Cox Business News

0 Comments

Are you also one of them who spends half of the day scrolling through the internet aimlessly? Do you also watch entertainment content most often on the internet? These destructive habits are becoming a major source of slaying your creative impulses. For the sake of blowing time, peers spend time on the internet by viewing entertainment content and scrolling through social media. However, slowly and steadily, these entertainment content may harm our mindsets. If you have a goal in your life to achieve something than you should prioritize your screen time. Overviewing of entertainment content kills our desire to upgrade ourselves. Our personalities are formed based on the content we consume every day. A theorist Norman Holland talked about the psychoanalytic analysis of “how identities are structured through a process of reading”.For him, this process includes some transactions. This reading includes all the material that we encounter in our daily lives through listening, reading, and watching. This is how our mindsets grow. These entertainment contents destroy our problem-solving skills.

Scrolling for entertainment content for hours will numb your mind and eventually we transform into lethargic, lazy, and unsuccessful in life because these contents do not help in evolving ourselves. To sum up, although entertainment is a source of pleasure and relief. On a critical note, it does not help you to build up since it is shallow and easy to grasp. It is a financial transaction between two parties in which one party is the seller and the second party is the Investor and leases it back from the investor. It is a good option for investors to avail because a lease gives 100% property value whereas typical banks cover only 60% to 70%. Lease buyback gives ownership to another party. It is a more profitable use of capital. Taking capital from the real estate asset and putting back in growth objectives and core business and no loss of control over the property. This deal also gives liquidity to pay down debt and invest in assets. To lease buyback on a property depends upon age and age should be according to eligibility criteria. The owner must have citizenship and monthly income. Property should be in ownership.  Advantages of lease buyback: There are many advantages of lease buyback. It is more beneficial for business owners like tax and working capital. It causes more cash flow, leaseback sale allows the previous owner to access capital, and in ownership of asset it can be tied up. This money is useful for growing business by paying debts. Both the parties are free from traditional lending, and use more flexible and independent leasing terms and avoid from Fesses. The company has the option to show the leased asset as an operating expense and not a liability. Here, show more debts to pay which benefits them to borrow more from the lender. In the end, a lessee cannot control the asset by purchasing. Tax benefits and entire lease payment go through the business expenses. Disadvantage: Loss of asset is possible and its payments are fixed and have no increasing or decreasing ratio. It has no flexibility. Judgment points: With Motels you will get peace of mind. We will find a lessee to buy back the property. Motels intends to lease buyback property to raise down payments and interest rates. Lease buyback is an especially useful method of increasing property value. Value increase on the day of offer and handle all financial needs. Its small rents are also good options. It is a major source of cash flow in the economy of business buyback agreements achieve profit from the sale of the property. If the buyer would like to obtain control of the property, they will pay an amount that is less than that of owned by the lease. Usually, the difference will be paid in cash with an immediate term on it. Sometimes seller needs cash for another form of finance and will agree to accept payment using a lease buyback. These contracts allow both sides to receive something out of the deal at an attractive price. This type of contract creates business sense. The initial and ongoing cost of owning property is high, especially for leaseholds and those who do not have to qualify for first-time buyer grants. The most communal problem is not buying according to affordability and the fear of buying an investment. The lease buyback policy on properties should be made mandatory so that the tenants have full confidence in their property and feel safe in investing in the property. The real estate property which leases period is less than 20 years/2lakh per annum. To be successful in food business, you must have the correct menu, price, and overall food service experience. However, you may not require a physical location. Owners and operators of Food Stalls and Mobile Food Trucks provide a valuable service while also making a solid living. The mobile catering industry today employs over 25,000 individuals and has over 6300 registered businesses. Starting a business is simple due to the minimal start-up costs and specialized knowledge necessary. Ice cream, roadside snacks, and sporting event pies and burgers will always be in high demand. Festivals have opened up new opportunities, such as mobile cocktail bars for private parties, juice bars, and specialty dishes, in addition to the classic favorites. With a food truck that sells specialty foods, you may test the market for the cuisine you wish to offer. Do experiment with menus, learn what others want to eat, and improve your cooking abilities. You may even use your mobility to find a pitch in a location where there is a ready market for your production. Some sites are more suited for certain dining types than others, and a food truck allows you to determine where your most enthusiastic consumers are. Of course, running a mobile business comes with its own set of difficulties. It could be costly to find a pitch. To comply with hygiene rules, you'll need high-quality equipment, and your truck will require frequent maintenance. You may need to raise food truck finances, and finding lenders to give the funds you require may not always be straightforward due to the nature of your firm. Your catering business has a variety of financing food truck options. Obtaining the appropriate financing is critical. Purchasing and converting a vehicle, purchasing a going concern, requisitioning, and refurbishment all require various amounts of money. Understanding various types of finances available is the first step toward obtaining the funds you require. They are as follows: Ready to start motile food serving service Funding for the purchase of a business Loans for small businesses Funding based on cash flow You may not require a new truck, you should be certain that whatever you purchase is capable of delivering dependable service. You might either purchase a truck that has already been transformed or arrangements for the installation of appropriate equipment. Purchasing an existing catering business, may be less risky than starting from scratch. Turnover, costs, and profitability may all be predicted more accurately. A secured loan help you pay loan for food business. You may have a longer payback period and cheaper interest rates than with other forms of loans, making monthly repayments easier to fit into your budget. Although you will not be required to put up any assets as security against the loan, you will be required to offer a personal guarantee of financing for food truck. You can get a merchant cash advance, which is becoming increasingly important for all types of businesses. ShaheenHamee Many people struggle to obtain financial relief in today's financial world, which is controlled by credit ratings and cash. Individuals with poor credit scores, as you might expect, fall into this category. Getting approved for restaurant loans with less-than-perfect credit, or even poor credit, can be tough. The majority of lending organizations will reject you based only on your credit score. Banks become considerably more cautious about lending money and approving loans when the economy is struggling and unemployment rates are high. Interest rates tend to rise, making it even more difficult for people with bad credit to make ends meet. For example, many people with weak credit are turning to instalment loans. However, if you're looking for a different loan for bad credit, there are plenty on the market. Here are a few examples: A Loan from a Credit Union: If you need a loan but have bad credit, a credit union loan may be an excellent option. A credit union loan typically offers a lower interest rate and better terms. Personal loans, credit cards, and other lending products are often available at credit unions, just as they are at banks. They even provide the same services, such as ATM access, cards, and mobile banking. The sole difference between the two is that banks are for-profit financial entities, whereas credit union loans are more concerned with advancing restaurant finance to members. The nicest thing about credit unions is that, being nonprofit organizations, they tend to pass along their savings to their members in the form of discounts, higher interest on savings accounts, or reduced interest on loans. To take advantage of these perks, you must first join a credit union, which has certain stringent conditions for potential members. Peer-to-peer lending is a type of lending where people lend to each other. P2P lending is a new way of doing business in the loan sector. Borrowers may be able to receive cash rapidly and invest money in loans by bypassing traditional banks and lenders. Individual investors can fund loans that others require through a peer-to-peer (P2P) lending system. This system is called bicycle financing for bad credit. It benefits both. Borrowers will be able to obtain loans that they would not be able to obtain from traditional banks and lenders, and investors will be able to lend their money in exchange for a substantial return. This service matches lenders with potential borrowers using web technologies. Borrowers fill out an application and, once authorized, see their interest rates. Obtaining a Home Equity Loan: A home equity loan is a sort of consumer credit that allows homeowners to borrow money against their house's equity. The amount you can borrow is determined by the difference between your home's current market value and the remaining balance. A home equity loan functions similarly to a mortgage, which is why it's referred to as a second mortgage. It's a good bad credit loan alternative, but you must be sure you can repay it. Meet Hassan Fayyaz, a student at a veterinary school who became a hero to stray animals during the COVID-19 pandemic. Savior for the speechless Ever since the COVID-19 epidemic hit the world, a number of services have been discontinued, businesses have closed their doors, and the majority of individuals living in shanty towns and the suburbs have continued to go hungry at least once each day. According to the World Food Programmed of the United Nations, the number of people who are at risk of starvation due to a lack of access to sufficient food is predicted to skyrocket to 265 million in 2020, which is an increase of 130 million from the 135 million who were at risk in 2019. Saviour for those who are unable of talking Hassan's primary concern during the early stages of the COVID-19 outbreak was for the animals who had been abandoned and how well they would fare. He said, "The only source of sustenance for the vagrants is the scraps of food that people living on the side streets offer them. They get their food from the garbage cans that are located outside of people's homes. If individuals don't leave their houses, there won't be any food for these homeless people ". After that, Hassan had the epiphany that he should do something for them. Because he was studying to become a veterinarian, he saw it as his responsibility to assist the needy strays by providing them with food on a regular basis. He did this in the spirit of a good Samaritan. I'd like to thank his mom and dad. They got him a puppy that they called Oscar while he was in the second grade. When he first told his parents about his intention to become a veterinarian, they argued about her choice. When asked about the endeavor, he stated, "The inaccessibility of the food in the locations where they discovered it in the past has had me thinking that someone has to step up to do something about it." Hassan began by providing food for fifty strays, but by the end of the lockdown, he was providing food for three hundred and fifty strays every day. In order to provide food for the stray animals, he traveled to as many regions of Pakistan as he could, including South Pakistan and Central Pakistan. He also prepared banners with a message that indicated that strays do not transmit the COVID-19 virus, and they begged people to help those that were innocent. This was done so that he could reach a wider audience. Hassan's posters quickly gained lakhs of views across social media after going viral in a short amount of time. Hassan received assistance in spreading his message even from Bollywood actors. "I'm glad to everyone who shared the images," he said, expressing his gratitude to all of the supporters who had been a helping hand throughout her campaign. "I'm grateful to everyone who shared the pictures." Hassan took to social media to appeal to the residents of the regions that he was unable to access, asking for assistance in locating sources of food for the dogs that had been abandoned there. And it was a successful attempt.

Nevertheless, there were some investigations that suggested that canines might be susceptible to infection with the virus. In light of this information, we questioned Hassan about the matter, and he quickly responded by saying, "There were many fake articles online that indicated the opposite and got so much further by dumping the pets at their home." he stated, in reference to the guidelines for safety, "The only safety measures I took were washing my hands frequently and wearing protective gear like masks and gloves while I worked. I believe that if the animals had transmitted the COVID-19 virus to me, I would have passed away a long time ago. And were urged to refer, for more information on the same, to the website of the WHO" There are ways to get financing for a food truck with bad credit, albeit it will be much more difficult. Your chances of getting approved are mostly determined by other aspects of your finances, the sort of loan you choose, and the lender you choose. Financing for food trucks with bad credit is more common with online lenders and fintech companies. The type of loan you choose will have a significant impact on your chances of being approved. Some food truck financing options place a greater emphasis on your credit score than on other factors, and vice versa. Negative credit has been made up for in many situations by a strong cash flow, collateral, and a large down payment. Equipment financing When most food truck business owners are just getting started, they rely on equipment financing. Equipment loans provide the financing needed to purchase or rent a truck, as well as other essential supplies, to get your firm up and running. Equipment financing can help you finance up to the full cost of the machinery you want to buy. You'll usually have to put down a small deposit, and the equipment will serve as collateral for the loan. Working capital loans: Working capital loans are perfect for companies that want a short-term increase in cash flow. During sluggish seasons, you can utilize the funds to meet operational expenditures, purchase goods, and finance other obligations. A working capital loan is also commonly used by food truck companies to stock up on food and supplies ahead of a busy season. Mercantile cash advances It's tempting to believe that merchant cash advances are exclusively available to retailers and wholesalers. However, all types of enterprises, including food trucks, use this type of funding. A merchant cash advance is effectively a loan based on the future sales of your company. Merchant cash advances work incredibly fast and are best for short-term financing needs. Your credit score will also have less weight when you apply for food truck financing. Business lines of credit:

A business line of credit is similar to a credit card in that it allows you to borrow more money and has cheaper interest rates. Borrowers are given a credit limit that they can draw from whenever they need it. Business lines of credit are popular because they are extremely flexible, can be used to pay for a wide range of business needs, and there is no obligation to use the entire amount at once. Unsecured lines of credit are less risky for borrowers, but they are also costlier. Business term loans When most entrepreneurs think of a business loan, they think of business term loans. Term loans provide you with a lump-sum payment that you repay over a predetermined length of time with fixed, monthly payments. Term loans can help you meet a variety of business needs, including employee recruiting, material purchases, debt consolidation, and more. They're particularly useful if you want to stick to a regular payment plan. It's tempting to believe that merchant cash advances are exclusively available to retailers and wholesalers. However, all types of enterprises, including restaurants, use this type of restaurant loan. An MCA is effectively a loan based on the future sales of your company. In other words, you'll get a cash boost now and repay it with a portion of future credit card purchases. Merchant cash advances are ideal for short-term financial needs because they function so quickly. When you apply for this sort of financing, your credit score will be less important. In this article, we'll go over five advantages of getting a merchant cash advance and why it can be the ideal financing option for your business. What Are the Advantages of Getting a Merchant Cash Advance? When you ask for a cash advance, you should expect the money to be put in your account within a week. Timing is an important part of any successful business, and a better cash flow could help. Getting authorized for a merchant cash advance is usually easier than getting approved for a loan or even some credit cards. The application process is straightforward, and it is frequently conducted online for business funding. Plus, even if your credit score isn't perfect, you might be eligible. If your motel earns a lot of credit card sales, a cash advance can be a good idea. A merchant cash advance isn't the same thing as a loan. You will not be required to make fixed monthly payments and will not be given a specific repayment period. As a result, if you have a slow sales month, you will remit a lower sum than if your company's sales are flourishing. Small business loans may have limitations on how they can be used. Finding a funding source that matches all of your demands might be tough when you have a budget constraint. One of the main reasons why merchant cash advances are so popular is because of this. After you've been approved, you'll most likely be required to repay a set amount each month, or suffer financial (and legal) consequences. A merchant cash advance, on the other hand, does not require you to put your assets on the line. You don't have to establish your worth because a cash advance is a sale of future earnings. You won't have to worry about a merchant cash advance provider stealing your assets because what you remit is based on your credit card sales. Consider the Benefits Before Applying for MCA: Although merchant cash advances may not be the best solution for every business, they can have a number of advantages, particularly if you don't qualify for traditional financing. A merchant cash advance may be your greatest (or only) source of capital if you haven't been in business for long or have a poor credit history. Every business owner faces unique challenges, but a cash advance is one of the most straightforward ways to obtain a fast business loan. Your truck is your livelihood, so you’re going to want the best deal. When you finance it with us, we won’t make you pay a single cent in interest until 36 months after your purchase date. That means if you take out a $50,000 one-week loan with no money down and no fees for 60 days of use, we won’t charge any interest for three years! If that isn’t enough of an incentive to use our services instead of another provider's, then consider this: We give our customers cash back when they decide to buy vehicles from us again within two years after they've used one of our trucks or trailers. Are you looking to buy a concession truck but you can't find them anywhere? We have a solution that will help you locate concession trucks for sale by owner. Your concession trailer, concession truck, or any other non-mobile equipment. Try using a classified advertising site like BackPage.com. This will allow you to post listings in your local newspaper/courier and online at sites such as Facebook, Craigslist, and other popular auction sites. Whether you are looking for a commercial truck to help you out of a bind or just looking for a classic looking truck, by-owner trucks come in all shapes and sizes. We provide information on companies that have concession trucks for sale so that you can make sure that any commercial vehicle is in great shape before committing to buy it. Finding a used truck for sale doesn’t have to be an ordeal. You can find all of the information you need right here at Stock X. We are your one-stop shop for easy and secure auto buying. Browse our inventory of used trucks, including auction vehicles, certified pre-owned vehicles, and more. There are a lot of advantages to being able to sell your vehicle or property when you no longer need it. You can make a lot of money with little effort and risk, and you don’t need to deal with banks or other people. One method is to sell used concession trucks from owners. There are a lot of people that want to sell their concession trucks for cash, but it’s not always possible for them to get the same amount of money selling their trucks. That’s why you should use our service, where you can advertise your truck and find buyers easily. Selling a concession truck is an easy way to make some extra money. But, to sell your truck and make the most money, you need to be able to advertise it well.

Concession trucks for sale are a cheap and convenient form of public transportation. Buying a used concession operator has never been easier with the help of this list. Because the market is flooded with offers from the seller, it's important to know how to find the best deal before you make an offer. One of the best ways to find commercial trucks for sale by owner at a good price is by using our website or mobile app. Here you can search numerous dealerships across the country that have lots of different types of vehicles available, including fairings and trailers. Conclusion: Finding a concession truck for sale by owner is not that hard at all. All you have to do is look online to see if anyone has posted a listing, and you’re good to go! Food franchises are among the most profitable, and food trucks are a worthwhile investment. Most food truck franchise owners generate close to or over six figures every year. Food truck trends are taking off. The industry is worth millions of dollars and continued growth is expected. When you are dealing with any type of truck, you should look at the cost of owning a truck. The more expensive it is, the more money you will have to spend to maintain a full tank and keep up with your insurance premiums. If it is not necessary for someone who lives in a city or town that has public transportation, then buying one may not be worth the price tag. If you are looking to buy a new truck and need a concession, then the lender is the best option for you. You will be able to get concessions according to your income and other factors such as your credit score. In this case, you apply for a low-interest rate or even no interest at all. The lenders also give discounts on loan rates if you have a good income or have stayed in a secured job for a long time. If your credit score is poor and you do not want any delay in getting money from them, then the lender can help in this situation as well by giving cash advances against the property that belongs to them so that they can recover their payment before its due date without any hassle from your side. You will be able to get the truck loan options concession on truck loan options. You can also take advantage of truck loan concessions. The vehicle is used for business purposes, and hence, you are eligible for various kinds of government subsidies. Concession on truck loan options is one way of looking at your truck. It can be a small one or a big one, but it all depends on the truck loan options and the truck that you own. The dealer may say it will be easier for them to sell your truck at the auction if it is paid off and you can make those payments until the end of your contract with them. Truck loans are a wonderful way to drive your wheels through the city, making money and all while having fun. However, there are lots of things that go into the decision of whether you should take out a truck loan. One of the most important things that you need to consider is whether you can afford it. If so, then we have an easy solution for you! Truck lenders can finance the purchase of your truck or construction equipment using a truck lease agreement or a loan. Truck leasing allows you to own the vehicle and keep it for a set period without placing any down payment on the truck. Truck leasing is especially helpful when there are no funds available but you need a new truck, so what are your options? Without taking money from your resources, you can go for a debt consolidation loan that will allow you to consolidate debts into one single payment. Debt Consolidation Loans provide access to lower interest rates and longer repayment schedules than credit cards, which might be more expensive and come with high fees and penalties. Conclusion:

We are proud to offer these options and hope they can be of use to you when looking for a loan. If you have any questions, please do not hesitate to contact us. The concession on truck loan options can be a wonderful way to get into a new truck or get an upgrade on your current vehicle. You may qualify for a concession if you are over the age of 60 years old, retired from paid employment, or receiving Centrelink benefits such as Newstart Allowance, Youth Allowance (job seekers), or Parenting Payment (partnered). If these conditions apply, then speak with one of our friendly staff who can discuss your options with you and advise whether they think they would be able to help you out! There are a lot of reasons to consider getting a truck loan. Truck loans can be a great option for many people, but they are not right for everyone. If you have any questions or concerns about truck loans, we would be happy to answer them! |

Cox Business News staff WriterJournalists from around the world writing to give you answers, with Assitant Editor Dr Muhammad Hassan Fayyaz for articles in June and July 2021 The Editor In Chief of Cox Business News

|

RSS Feed

RSS Feed