|

A ringless voicemail, also known as a voicemail drop, is a method wherein a pre-recorded audio message is dropped into a voicemail inbox without the connected telephone initially ringing. This approach is also known as ringless voicemail. This method is often associated with debt collection agencies and spam, which is commercial email that was not asked for. Legal Status in America: The petition to keep the technique from being regulated by Robocall rules was sent to the Federal Communications Commission (FCC) at first, but it was pulled after it caused a big fuss. The courts in the United States have repeatedly and consistently ruled that voicemail is subject to the Telephone Consumer Protection Act in the same manner as a regular telephone call. This has the effect of rendering illegal voicemail drops that contain unsolicited advertisements or calls from debt collectors in all situations in which the recipient phone number is associated with a rate-limited account. Even if the call was not answered or the voice message was not listened to, sending such messages is still a violation that can result in penalties and civil liabilities. Furthermore, the person who was phoned does not have to provide evidence that they were charged for any calls in order to win the case. When a person's phone number is included on the FTC's "do not call" list, it is also against the law for that person to receive such messages. conclusion In a nutshell, it is illegal to call or leave voicemails on phone numbers registered with the federal do not call list, and if no other decisions have been made, it is safe to call those who are not on the do not call list for the time being. Legal Status in Canada: The Canadian Radio-television and Telecommunications Commission (CRTC) lets people check their voice mail without stopping what they are doing. Federal Communication Commission on Ringless Voicemail The Federal Communications Commission (FCC) has not yet rendered a decision regarding the legality of Ringless Voicemail or whether or not this technology constitutes a "call" as defined by the Telephone Consumer Protection Act (TCPA). Also, it hasn't put any restrictions on ringless voicemails (RVM). There have been a number of petitions filed with the FCC by various organizations, the most notable of which was all about the Message, LLC in 2017 and VoApps in 2014, who were both seeking a declaratory ruling from the FCC that the RVM technology was not subject to the TCPA regulations. These petitions have been unsuccessful. But because of how people felt and what they said, both groups decided to pull their applications before a decision was made. At the time that this story was being published, no notice of appeal had been submitted, and the FCC had, up until this point, refrained from expressing any view about the case. Is Ringless Voicemail Legal or Not? Understanding the technology that enables this procedure to be carried out is necessary for any attempt to provide a solution to this issue. When you call a number and there is no answer after a certain amount of time, the phone will beep and ask you to leave a voicemail, after giving you the option to do so after the beep. This is the standard method for leaving a voicemail. Now, here's the catch. Using technology, ringless voicemail is able to leave a voicemail on a prospect's phone by entering through the back door. It does this by utilizing a technique known as Adaptive Signaling technology, which permits the message to be routed straight to the enhanced service platform of the voicemail service provider. This is a voicemail server space that is allotted to the user's phone number. It is important to keep in mind that voicemail messages are not kept on the user's actual phone but rather on the server space of the user's phone that is handled by the user's phone carrier. This is what enables the technology to be able to transmit a voicemail to a phone without causing the user's phone to ring when the message is delivered. The user of the phone will get a notice telling them that they have a new voicemail message after the voicemail has been successfully sent to the server space that is associated with the particular phone number that was used. Ringless voicemails are not legal. Unless, of course, you have provided them with legal consent authorizing them to make telemarketing calls to your phone, in which case the telemarketing company must then provide you with an easy mechanism to allow you to opt-out at any given time. If you have provided them with legal consent authorizing them to make telemarketing calls to your phone, then the telemarketing company is required to do so. Telephone Consumer Protection Act (TCPA) On Ringless Voicemail The Telephone Consumer Protection Act prohibits any person within the United States of America from "making any call... using any automatic telephone dialing system or an artificial or pre-recorded voice... to any telephone number assigned to a paging service, cellular telephone service, or any other service for which the called party is charged for the call." This includes calling any telephone number assigned to a service that charges the called party for the call. Ringless voicemails aren't considered phone calls according to the law; 47 U.S.C. & 227 (b), (1), (A). This is something that telemarketers and collection agencies have long maintained (iii). In the case of Saunders v. Dyck O'Neal, United States District Judge Gordon J. Quist of the United States District Court for the Western District of Michigan ruled in favor of the consumer on July 16, 2018, declaring that a Ringless Voicemail message (RVM) is considered to be a "call" that is governed by the Telephone Consumer Protection Act (TCPA). He did some research on the usual meaning of the verb "to call," and he discovered that the term "call" implies communicating with or attempting to contact a person over the telephone. He also pointed out that the plaintiff had received the notifications and listened to the voicemails on her phone, and that, as a result, the outcome was the same regardless of whether or not her phone had rung before the voicemail was left. He said this was evidence that the plaintiff was not at fault. If it is against the law to phone the customer, then you cannot. Federal Rules for Telemarketers In response to consumer concerns over an increase in the number of commercial calls and automated, pre-recorded communications, the Telephone Consumer Protection Act (TCPA) was enacted in 1991. Invoking the power granted to it by the Telephone Consumer Protection Act (TCPA), the Federal Communications Commission (FCC) issued rules that require telemarketers, who are defined as anybody who solicits you by telephone, to submit the information listed below:

Reference

0 Comments

As a busy small business owner, managing your finances is a top priority and critical for success. The challenge is, it can often be difficult and time-consuming. That’s why, we have put together a list of some of the best small business finance books.

There are many books out there that are directed toward helping small business owners manage their finances, and finding quality books can sometimes be difficult. Luckily for you, these 20 books will help you get inspired, manage debt, retire early, and more.

Reviews: 4.3 out of 5 stars(16) Price: $19.29 Reviews The issue of funding is one of the biggest pain points for small- and medium-sized businesses and one that comes up on a daily basis. Whether you're unsure about how to go about getting a loan, unfamiliar with the different options available to you or confused as to which would be the right solution for your particular business, Business Funding For Dummies provides plain-English, down-to-earth guidance on everything you need to successfully fund your business venture.

Price : $15.95Best Sellers Rank #249,582 in Books (See Top 100 in Books)#57 in Green Business (Books) #256 in Banks & Banking (Books) #482 in Corporate Finance (Books) Customer Reviews 4.3 out of 5 stars Reviews If anyone wants to get an SBA loan, or any other kind of financing, must read this book. It should be a part of every small business owner's library. It will help to navigate nearly any funding application with practical advice on how to confront every obstacle which face to getting financed from lack of collateral to low credit scores.

Price : $15.79 Customer Reviews 4.8 out of 5 stars (21) Review Applying for a business loan can be difficult, time intensive, and expensive, but it doesn’t have to be. This book was written to provide a straightforward road map to help you obtain approval. In Part One, traditional business loans are compared to business loans backed by the Small Business Administration (SBA) based on 21 factors. In these first two chapters, you will learn why every entrepreneur should consider an SBA loan. In Part Two, an overview of the SBA’s flagship programs is discussed, including how to meet the SBA’s eligibility requirements, a low bar if you follow the guidelines in this book. In Part Three, you will learn how to evaluate yourself, your partners, and your business(es) from a lender’s perspective. With this knowledge, you will be able to highlight particular strengths that lenders want to see and mitigate weaknesses that could cause processing delays and even loan declination. In Part Four, you will learn how to prepare a summary business plan specifically written to obtain financing. A business plan is necessary for financing to take advantage of growth opportunities, acquisition of third-party businesses, and new businesses. In Part Four, you will learn which parts of the business plan to devote more time to and which other sections only need limited information or may be skipped altogether. In Part Five, you will learn how to prepare your business loan application correctly. Incomplete/incorrect applications cause major delays in the loan approval process. Practically speaking, complete applications always take priority over the incomplete ones. Incomplete applications are often just set aside regardless of when they were initially submitted. In fact, many lenders will simply decline them due to the time that it takes to educate borrowers on how to properly prepare a complete application. After finishing this book, you will have the ability to highlight the strengths (and mitigate the weaknesses) of your business from a lender’s perspective, provide a simple business plan identifying how your business will be profitable for the long term, and accurately prepare a business loan application package that can be immediately submitted through underwriting without delay. As of fiscal year ending September 30, 2014, the US Small Business Administration enabled small businesses to obtain more than $23 billion in business funding. For fiscal year 2015, the SBA has budgeted to support more than $32 billion in business funding. This is your year to obtain financing to transition your business to the next level.

Reviews: 4.5 out of 5 stars(21) Price: $14.95 Review

Price: $12.99 Reviews There are so many funding agencies willing to give grant to fund business for FREE. People are not just aware. Others are simply lazy to apply consistently. It does not matter the country you live, there must be grant givers, government agencies, donor agencies, charity/philanthropic individuals, Non-Governmental Organizations, and international development agencies interested in funding small and medium scale enterprises. There must be institutions interested in empowering youths aspiring towards vocational and entrepreneurship initiatives. Don’t be afraid to apply for the grant opportunities. Get someone to help package the proposal or vet application. This book is an eye opener to the reader who may not know that these realities exist. The specific funding agencies listed here may not apply to specific nation or location but take a cue and do research.

Reviews: 3.5 out of 5 stars (20) Price: $10 Review This is the second book I have read by Tokan, and I like the author's style of getting the message across. He presents the material in a fashion that is easy to understand for individuals that are just starting out in business. But the information does not just target beginners. I think that one of the biggest takeaways was the concept of how to appeal to a bank manager. There are numerous mistakes that many businesses make when asking for funding from a bank. The book provides tips on what you can do to provide confidence that you will be successful.

Price: $9.99 Reviews How to Get a Business Loan will dramatically enhance your chances of putting together a deal you can live with and profit by. It has vast variety of information.

Price: $9.97 Reviews: 4.1 out of 5 stars(32) Customer Reviews: 4.1 out of 5 stars(32) Reviews After reading this book got that it has a multitude of information. Websites are compiled at fingertips, information is provided about YouTube marketing and crowd funding. It keeps anyone from having to do as much research.

Reviews: 4.3 out of 5 stars(66) Price: $9.97 Reviews This book has one chapter on food trucks that is almost verbatim copy and pasted from Wikipedia "food trucks" including the cover art. The rest of the book is just generalized on starting a small business, and again a lot of course.

Price : $8.99 Ranking: Best Sellers Rank #1,942,424 in Books (See Top 100 in Books) #287 in Crowdfunding (Books) Reviews The director of the Small Business Finance Institute in Atlanta, GA, is a former banker and true braintruster when it comes to small business finance and investing generally. He is a worthy expert source of information. This book has every minute information about the business.

Reviews: 4.2 out of 5 stars(19) Price: $8.99 Reviews If you want to get an SBA loan, or any other kind of financing. It should be a part of every small business owner's library. It will help you navigate nearly any funding application with practical advice on how to confront every obstacle you face to getting financed from lack of collateral to low credit scores.

Price: $4.99 Reviews The workbook will guide you through the process you need to follow. It tells you the questions that you need to consider, the numbers you need (and how to get them), and supporting documents you need to gather. The main purpose of a business plan is to aid YOU in running YOUR business. So the workbook has been designed for you to write the information in and refer back to as needed. If you need to supply your Business Plan to another party, such as a bank if you’re looking for finance, then it’s simple to type up the various sections for a professional document.

Price: $4.99 Reviews A brief segment on receiving a Pay Check Protection Loan from the SBA, and how to ask for forgiveness. Most small black owned businesses have faced economic uncertainity and has reached out for support.

Reviews: 3.0 out of 5 stars Price: $4.95 Reviews If you have or are starting a small business, you need this book. Definitely a must read. An eye opener on obtaining funds.

Reviews: 3.3 out of 5 stars(26) Price: $4.49 dollar Review I heard about this book while researching intra-family mortgages. I had questions about how to "close the deal" and that information was not available anywhere online that I could find. One of the websites talking the praises of intra-family mortgages recommended this book. I ordered it, and it had the exact information that I needed to perfect the loan.

Reviews: 5.0 out of 5 stars(3) Price: $3.99 Reviews This business book is different. Unlike every other book you’ll read with titles like “How To Craft the Perfect Business Plan in 89 Incredibly Simple Steps”, this book is different. It’s a simple “How To” guide for creating a Business Plan that’s right for you and your business and also an easy to follow workbook. This book offers a complete or easy process through which anyone gets be of assistance.

Review: 3.5 out of 5 stars (15) Price: $3.75 Reviews Most books have the font so small and it’s hard to read, but this book is easy to read. This book has a lot of useful information in it as someone who had little to no knowledge on payday loans. This book was really good with the basics such as learning to calculate interest and fees on loans, business requirements such as license business registration, insurance and etc. Great book for someone who need basic information on how to start a payday loan business.

Price: $3.50 Reviews It provides great in sequence about how you obtain start your business.

Review: 5.0 out of 5 stars(1) Price: $2.99 Review It provides information on small business loans, including how to fill out applications and deal with business lenders

Reviewed in the United States on July 23, 2020 Review I recently purchased this book and find it is easy to follow. It has a multitude of information. Websites are compiled at your fingertips, information is provided about YouTube marketing and crowd funding. References

We live in a post-caller ID world. What do you usually do when you get a call from an unrecognized name or number? If you’re like most of us, you probably ignore it or decline it. In fact, 80% of calls end up going to voicemail.

According to RingLead, the average sales rep leaves 70 voicemail messages per day. That adds up to an average of 25 hours/month/rep. But here’s where the digital world meets the analog world, allowing you to harness the strength of phone calls while getting around our proclivity to screen them and to opt out of the call-listen-leave-same-message tedium: voicemail dropping. What is a Voicemail Drop? At its simplest, voicemail dropping — also referred to as a pre-recorded voicemail — is literally ‘dropping’ a pre-recorded message into someone’s voicemail inbox. Their phone doesn’t ring, but they do get a notification that they have a new message. Voicemail automation is a type of inside sales technology that is designed to accelerate the process of leaving voicemail messages. How Voicemail Drop Works? The moment a call goes to voicemail, a Voicemail Drop system enables reps to select a message from a library of prerecorded voicemail messages and then “drop” that voicemail with a single click and then jump to the next call. How to Use It? It’s effective. While it’s easy to ignore or decline a phone call, people are far less inclined to delete a voicemail without at least listening to it. In fact, voicemail drop providers like Drop Cowboy boast a response rate between 5-20%.

Instead of individually calling dozens of numbers, waiting for the call to go to voicemail, listening to the greeting, and leaving your message, you can record one personalized message for a segment of your call list and instantly send it out with one click. Save those messages in your personal library, and the right message is always waiting and ready to go. How much time would that save per rep or sales team? If one rep spends an average of 25 hours/month, then a team of five reps loses 125 hours per month to voicemail alone. Take those hours back. Finally, you can connect and engage without having to bother or interrupt prospects at home and work. They hear the message and respond at their convenience. Using Voicemail Dropping with Prospecting Prospecting is an art and a science. If you’re involved with sales in any way, you’ve probably got a tried-and-true method for prospecting already (hint: email). You’ve got your favorite tools and services and likely an email prospecting template or two. So here’s the good news: adding voicemail dropping to your prospecting arsenal is easier than you think. In fact, you have the skills and know-how already. The golden rule is to treat a voicemail drop like you would a cold email: personalization and relevancy are of the utmost importance. If it’s true for email prospecting, it’s true for voicemail dropping. Other Potential Advantages of Voicemail Drop Voicemail Drop systems also present some other advantages to sales reps. Some of those advantages include: Quality-Using prerecorded voicemails ensures that every voicemail message sounds perfect and lively. Reps often sound less enthusiastic toward the ends of their workdays after leaving many manual voicemail messages. Optimization-Using prerecorded voicemails enables managers to test which voicemail messages get the most responses. This data can help reps optimize reps’ sales 1communication. Personalization– Prerecorded voicemails can be framed around campaigns to enable speed while also maintaining a degree of personalization. As an example, a prerecorded voicemail could mention the name of an ebook that a prospect downloaded when reps are calling down a list of leads that downloaded that particular eBook. Let's talk about Amazon. The world's largest online retailer and a well-known cloud service provider is Amazon. Amazon started as an online bookstore but has since evolved into a web-based company that primarily specializes in e-commerce, cloud computing, digital streaming, and artificial intelligence services. In addition to its Seattle headquarters, Amazon has regional websites, software development centers, customer service centers, data centers, and fulfillment centers on the world. Amazon products and services

Following are the five cheapest and most popular open signs on Amazon VEVOR This is a very bright 31.5" x 15.7" horizontal LED neon pattern "Open". Customers can easily find your business, bar, motel, or storefront thanks to this bright LED neon sign with high quality light stripes visible from over 100 feet away. This neon open sign is made from professional PVC material, making it extremely weather resistant and portable. Translucent PVC material with excellent light transmission allows more light to pass through for a more uniform brightness. It is very easy to use and install. The illuminated LED neon sign comes with a hanging chain and power adapter. Simply plug in and hang your eye-catching LED sign to see the results. The OPEN neon sign stands on a sturdy frame and is perfect for wall or window mounting. It's great for windows, walls, shops, restaurants, and many other places, as well as retail and hospitality businesses. Rating on Amazon VEVOR rating is 4.5 out of 5 Price is $29.99 Good Reviews Simply, this product is just what others wanted. Bad Reviews The sign was sent with a single sheet of paper written in Chinese. No more guidelines. I couldn't get it to be programmed. Even worse, when I went to return it, I discovered that the shipping fee would be MORE THAN $46. Headline Sign There is a large "OPEN" sign in all caps on one side. On the other side are the words ''closed'' and ''please call again'' and a timer that says ''I will come again''. The hands of the dial can be adjusted freely. 11.5" x 6" Double Sided Open and Close Sign Return time is indicated by red clock hands. Sturdy plastic construction in blue/black/white. Rating on Amazon Headline sign rating is 4.5 out of 5 Price is $8.12 Good Reviews Easy to use. Bad Reviews Although it has a barcode sticker on it that says "New," nothing about this product suggests that it is a used CD, only one that was very plainly used. There are no scratches on the casing, no plastic wrapping, and what appears to be food residue on top of that. I only included the extra star since the CD itself does not appear to have scratches, but I am quite disappointed because I mostly bought this for the album case and booklet, and the ones I got are really, really bad. Accuform aluminum safety signs Its rounded corners and 3/16" mounting holes make it an easy installation. The image is printed on sturdy metal and finished with a clear UV protective varnish. Its environmental effects fade, splash, wash out. OSHA 29 CFR 1910.145 complies with these guidelines. Rating on Amazon Accuform aluminum safety sign rating is 5 out of 5 Price is $ 21.49 Reviews There are no reviews yet for this sign. It has a rating of 5 out of 5. Open LED Sign The LED open indicator is attractive. The Pulse Vinyl Neon Open Sign is very vibrant and eye-catching. Many spectators stopped to see the open sign. Save on your heating and electricity bills! It is better than comparable neon products as it consumes less energy. Dimensions are 10 x 19 inches. Retailers and business owners across the country rely on it for its durability and reliability. It uses a standard 110V US wall adapter. Installation of this neon light sign is very easy. Simply attach the chain, plug in the power adapter, turn on the sign, and you're ready to go. Good Reviews The signs are nicely illuminated and offer the option of running, steady, or flashing lights to draw in potential clients. The controls are simple to operate, and the vibrant colors are vivid. I adore this product, which is really affordable. Bad Reviews It's technically sound and reasonably priced. Better than absolutely nothing. I've used it for a week now, which is enough time to assess its pros and cons. First, the positive: it is technically functional, is lightweight, and was reasonably priced. Technically, it’s awful now. Even when gazing directly into the sun, it's not particularly bright. NAHANCO NMSKBO is black and white with an open/close sign.

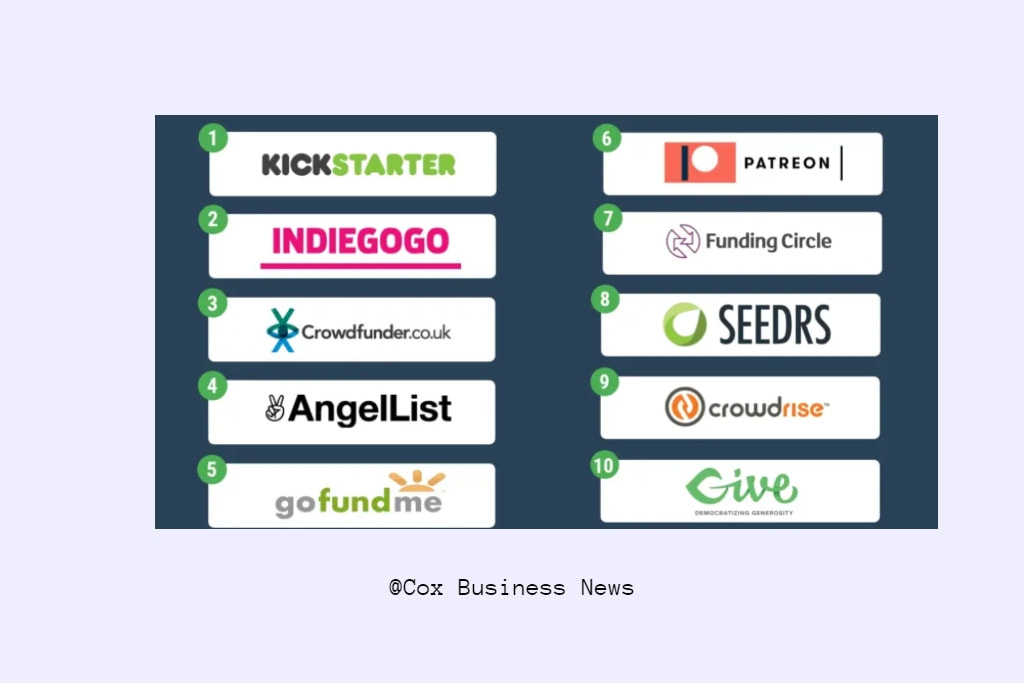

NAHANCO NMSKBO There is a metal open/close sign printed in white on a black background. Doors and windows look attractive thanks to the practical, durable and commercial-quality closed and closed signs. A convenient double-sided design with two pre-drilled hanging holes; one black metal chain; S hooks in black for hanging; and suction cups are included in the sign package. Rating on Amazon NAHANCO NMSKBO is black and white with an open/close sign rating is 4.5 out of 5 Price is $24 Good Reviews The sign is excellent; it's made of metal and has adorable drawings. However, it doesn't stay in place. The suction cup is excessively heavy. Bad Reviews The display is lovely outside the office door. The one and only issue is that it flips around on the door and even twists when there is even the slightest breeze. I am currently researching techniques to fasten it to the door a little bit further. Crowdfunding: The process of obtaining financial support for a venture or project by soliciting contributions from a large number of individuals, most frequently through the use of the internet in today’s modern times, is known as crowdsourcing or crowdfunding. Crowdsourcing and alternative finance are two other names for the practice of crowdfunding. In 2015, crowdfunding campaigns successfully raised more than $34 billion USD all over the world. "Crowdfunding" refers to registries that are run through the internet, but similar ideas can also be used through mail-order subscriptions, benefit events, and other means. The modern model of crowdfunding is generally based on three different types of actors, including the project initiator, who proposes the idea or project to be funded; individuals or groups who support the idea; and a moderating organization (the "platform") that brings the parties together to launch the idea. A diverse array of for-profit entrepreneurial endeavors, including artistic and creative projects, medical expenses, travel, and community-oriented social entrepreneurship projects, have been funded through the use of crowdsourcing. Despite the fact that it has been hypothesized that crowdfunding has strong ties to environmentally friendly practices, empirical validation has demonstrated that environmental friendliness plays only a minor role in crowdfunding. Its utilization has also been criticized for the funding of quackery, particularly expensive and questionable cancer treatments. The platforms listed below provide crowdfunding services.

Indiegogo Indiegogo is a website based in the United States that facilitates crowdsourcing and was established in 2008 by Danae Ringelmann, Slava Rubin, and Eric Schell. San Francisco, in the state of California, serves as the organization’s headquarters. The website was one of the first to provide crowd funding, making it a pioneer in the field. People are able to request financial support for an idea, a charity, or a new business venture via Indiegogo. Indiegogo deducts a fee of 5% from each contribution made. These fees are in addition to the standard credit card processing fees levied by Stripe, which are 3% plus $0.30 per transaction. Every single month, the website is seen by over fifteen million individuals. The website uses a system that is based on rewards, which means that donors, investors, or customers who are willing to help fund a project or product can donate and receive a gift rather than an equity stake in the company. This is because the system the website uses is based on a rewards-based model. Indiegogo has teamed up with Micro Ventures to offer equity-based campaigns starting in November 2016. This is in response to rule changes made by the Securities and Exchange Commission earlier in 2016.This will enable unaccredited investors to participate in campaigns involving equity stakes. In 2014, Indiegogo introduced a new tool called Indiegogo Life, which allows users to raise money for a variety of life-related causes, including crises, medical costs, celebrations, and other life events. There was no platform fee associated with Indiegogo Life campaigns Link: https://www.indiegogo.com/ Campaign rules Users who are between the ages of 13 and 17 are not permitted to use the website without the permission of a parent or legal guardian. The owners of campaigns are not allowed to develop campaigns that try to gather money for actions that are against the law, that are obviously fabricated, or that pretend to do something that is not achievable. If the campaign is going to give benefits, it cannot offer any cash inducement, any sort of stake in the firm or enterprise, or any other type of interest. The campaign is not permitted to provide any kind of lottery or gambling, as well as alcohol, drugs, guns, or ammunition of any kind. A campaign is not allowed to spread ideas or opportunities that might result in physical harm, loss of life, destruction of property, or any other act that infringes on the rights of another individual in any way that can be communicated. Kickstarter Kickstarter is a global crowdfunding site with its headquarters in Brooklyn, New York, and it places a strong emphasis on creative projects. Kickstarter is an American public benefit corporation. The purpose of the organization is described as being to "assist in bringing creative ventures to reality." As of July 2021, Kickstarter has collected $6.6 billion in pledges from 21 million supporters for the purpose of funding 222,000 projects. These projects included things like films, music, stage events, comics, journalism, video games, technology, publishing, and food-related endeavors. In exchange for their financial support, backers of projects on Kickstarter are often given access to unique experiences or physical goods. This technique may be traced back to the subscription form of art patronage, in which artists would approach their audiences directly to ask for financial support for their work. The entire amount of funds raised is subject to a charge that is equal to 5% of the total amount. An extra cost of between 3 and 5% is applied by their payment processor. In contrast to many other online communities that facilitate fundraising or investment, Kickstarter does not assert any ownership over the projects that its users create or the work that they produce. The website pages of projects that were started on this site are archived indefinitely and made available to the general public. Once the funding goal has been reached, the projects and any uploaded media can no longer be edited or removed from the site. Categories The creators of each project place it into one of the 13 main categories and one of the 36 subcategories. These include the fields of art, comics, dance, design, fashion, food, games, music, photography, publishing, technology, and theater. Film and video and music are the two most popular categories; as seen by the amount of money they have brought in between them. Together with the Games category, this group accounts for more than half of the total funds raised. The combined total of video games and tabletop games accounts for more than $2 of every $10 that is pledged to projects on Kickstarter. Guidelines Kickstarter has outlined three guidelines for all project creators to follow in order to maintain its focus as a funding platform for creative projects. Creators can only fund projects; projects must fit within one of the site’s 13 creative categories; and creators must abide by the site’s prohibited uses, which include charity and awareness campaigns. Hardware and product design projects submitted to Kickstarter must adhere to some extra standards. The following are examples:

Link: https://www.kickstarter.com/ GoFundMe During this round of the process, participants have the opportunity to provide a description of the reason they are raising money, the amount they are hoping to collect, and to add images or videos. Once the website has been constructed, GoFundMe enables users to share their project with others by integrating connections to social networking sites such as Facebook, Twitter, and others, as well as providing email sharing options. Donations to a user’s cause may then be made on the website using a debit card or credit card , and the user can monitor how much money has been raised. People who donate money are given the opportunity to submit feedback on the website. In the event that the user does not receive any donations, there will be no fee paid. [14] Each transaction made on GoFundMe is subject to a 2.9% processing fee as well as a $0.30 fee. Link; https://www.gofundme.com/ Fundable Fundable founders Wil Schroter and Eric Corl established Fundable on May 22, 2012, and the day was chosen as the launch date. There is no connection between the current business and the crowdfunding website that operated under the same name and at the same website address from 2005 to 2009. Its origins may be traced back to a system that was centered on incentives. Backers make monetary contributions to fledgling firms in exchange for perks or for the opportunity to place advance orders for the products that the companies plan to manufacture following the conclusion of the campaign. A platform that is built on equity, which went live in August of 2012. After the JOBS Act was passed and signed into law by President Barack Obama in early 2012, Fundable was one of the first equity crowdfunding portals to be established in the United States. At this time, only qualified investors who have a minimum net worth of one million dollars are eligible to participate in businesses using the equity side of the platform. The company requires all prospective clients to pay an upfront monthly fee beginning at $179, regardless of the result of their application. Fundable is able to function thanks to the assistance and financial backing of Virtucon Ventures, an investment business located in Columbus, Ohio, that is the only investor in the company. In addition to that, it is supported by a select group of business consultants, one of which is Mark Nager, the CEO of Startup Weekend. Link: https://www.fundable.com/Fundable LLC Wefunder Wefunder was founded on the principle that each individual, regardless of their financial situation, ought to be able to invest in a business. At the right moment, only accredited investors are legally allowed to put money into new businesses, and each of these investors needs to put up a minimum of $1,000 in order to have a stake in the company. Once the complete deregulatory changes that were promised by the JOBS Act are implemented, the firm has plans to reduce the minimum investment required to become an investor to $100. According to Tommarello, "filling the financial gap between angel investors and that first large round of money" is the mission of We Funder. Link: https://wefunder.com/ StartEngine StartEngine generates revenue through the collection of fees from issuers, or the business that is selling shares. As a result, the vast majority of our offerings do not cost an investor a single cent. Having said that, issuers have the option of offsetting the expenses by requiring investors to pay a charge of 3.5%. In addition to the cost of the share itself, investors will be required to pay this fee. As a processing fee, your total amount charged and the number of shares you will get will be clearly mentioned on the investment form. There are no additional costs associated with investing, whether you make your payment by an ACH transfer or a credit or debit card. There is a possibility that your bank will assess additional costs in connection with the wire transfer of funds if you choose to make your payment using that method. If you intend to conduct a wire transfer, it is imperative that you inquire with your financial institution about the associated expenses as soon as possible. This will allow you to prepare for and pay for any necessary extra transfer fee Link; https://www.startengine.com/ RocketHub RocketHub makes it possible to engage directly with fans through social media and raise money for causes. Project leaders, also known as fundraisers, are responsible for their own public relations and publicity through social media platforms such as Facebook and Twitter. Users specify a campaign timeframe, a target funding goal, and the "perks" they will give in exchange for donations when they publish a campaign on the platform. In a general sense, RocketHub is comparable to sites such as Kickstarter, Sellaband, and Pledgemusic. On the other hand, even if the specified fundraising goal is not met by the deadline, the project leader is still allowed to keep the money that has been gathered for the campaign. If the project meets its funding goal, RocketHub takes 8% of the total amount collected in addition to the 4% payment processing fee. Link: https://www.crunchbase.com/organization/rockethub CircleUp CircleUp is a San Francisco-based financial technology company that mostly works with new businesses in the consumer products industry. Since its formal launch in April 2012, CircleUp has assisted a number of consumer firms in raising equity funding. Some of these companies include Back to the Roots, Halo Top Creamery, Little Duck Organics, and Rhythm Superfoods, as well as a few more. General Mills has an investment fund, and they have partnered with CircleUp so that they can invest in other companies that are listed on CircleUp. CircleUp’s equivalent of an exchange-traded fund (ETF) for early-stage private marketplaces is called the Marketplace Index Fund. The minimum amount that may be invested in the fund is $25,000.https://circleup.com/ Link; FundRazr FundRazr employs the donation/perks crowdsourcing model, which is available for usage by organizations, charities, and personal causes. There are three price levels available for FundRazr: free (a platform charge of 0%), standard (a platform fee of 5% for expanded features), and pro (fee recovery models). If no funds are raised, there will not be a charge for the service. Users have the ability to set up a campaign page exclusive to their cause on FundRazr. The page can then be sent to supporters via social media, emailed to them, or embedded onto a website that is not affiliated with the cause in order to request money. Facebook users may publicly demonstrate their support for a cause by leaving comments, sharing content, giving likes and hearts, and donating money. Users are able to deposit and receive funds via PayPal thanks to FundRazr’s connection with the online payment service. Keep It All and All Or Nothing are the two campaign options that users of the fundraising platform have at their disposal in order to raise money. When a user selects the Keep It All option, it indicates that the total amount of money received by the campaign will be put into the user’s account, providing the user with immediate access to the cash. If the campaign does not accomplish its objective by the specified time, then the contributors will not be charged and the user will not get any funds as a reward. This is the "All Or Nothing" model. In other words, the user always has the option to withdraw from the campaign if it does not succeed in raising enough money to get the project off the ground. Microventures MicroVentures is a platform that facilitates equity crowdfunding and offers investments in startups in their early stages. MicroVentures facilitates connections between authorized investors and start-ups, enterprises, and services that want to raise capital or take part in certain secondary market possibilities. It is the only major crowdfunding platform that also functions as a broker-dealer and is registered with the Financial Industry Regulatory Authority (FINRA) and the first to successfully lead an investment portfolio firm to a profitable exit. As of the month of October 2013, MicroVentures had successfully raised a total of twenty million dollars from forty-five different companies, including Twitter, Facebook, and Yelp (before they reached the public markets). listing of companies and conducting research on them. MicroVentures provides funding for new businesses in a variety of sectors, including

Link : https://microventures.com/ CrowdSupply: Crowd Supply is an online platform for crowdsourcing that is headquartered in Portland, Oregon. The site claims to have "almost double the success rate of Kickstarter and Indiegogo" and collaborates with creators who utilize it to provide mentorship similar to that of a business incubator. So far, the platform has raised over $1 million. Some people believe that the meticulous project management that Crowd Supply provides is the answer to the high proportion of failed fulfillment attempts that other crowdfunding platforms experience. Additionally, it functions as an online store where the inventory of winning campaigns may be purchased. Andrew Huang’s open-source laptop design, Novena, is one of the most notable initiatives to come from this platform Fundly: The online fundraising platform Fundly is referred to as "crowdfunding." It makes it possible for organizations that are not-for-profit, charities, political campaigns, clubs, schools, teams, and churches, as well as other causes, to raise money online from friends, family, colleagues, donors, and other supporters by using email, Facebook, Twitter, LinkedIn, Google, and other social media networks. Additionally, it is an application for use on social networks such as Facebook and LinkedIn. Donations are processed through the use of WePay. When they make a gift, donors are expected to pay a fee. Other sites similar to Fundly include GoGetFunding, Indiegogo, and Kickstarter. The amount of money raised determines the fee that must be paid to use Fundly. Individual campaigns are assessed a fee equal to 4.9% of the cash received, in addition to credit card processing fees of 3%. When a campaign reaches a specific donation threshold, Fundly will reduce the proportion of the fee that it charges for using the platform. Contributions to campaigns that raise between $50,000 and $500,000 are subject to a 4.4% fee, donations that raise between $500,000 and $1,000,000 are subject to a 3.9% fee, and donations that raise above $1,000,000 are subject to a 2.9% fee. Link: http://fundly.com/ Kiva : Kiva is a debt crowdfunding platform that is available to any small business in the United States. The catch is that there is no interest, and the amount that can be borrowed is typically no more than $10,000. To be eligible for funding through Kiva, you will need to plan a campaign and collaborate with a Kiva representative; however, your credit will not be checked. Instead, it uses the approval of your contemporaries as the basis for determining your creditworthiness. Since the company’s inception, it has provided more than $1.25 billion in loans to customers all over the world. EquityNet: Since 2005, EquityNet has been running one of the most successful and comprehensive platforms for business crowdfunding. To plan, analyze, and raise capital for privately held businesses, members of the entrepreneurial community utilize the multi-patented EquityNet platform. This platform is used by thousands of individual entrepreneurs and investors, as well as incubators, government entities, and other members of the entrepreneurial community. Entrepreneurs all around North America have been able to generate more than $500 million in equity, debt, and royalty-based finance with the assistance of EquityNet, which gives access to thousands of investors. Because the firm is not a registered broker-dealer, it does not participate in the process of moving money from one account to another. Following the decision made by the United States Securities and Exchange Commission on September 23, 2013, to lift the ban on general solicitation, EquityNet granted permission to businesses using its platform to make use of the new rule established by the SEC and publicly advertise the fact that they are in need of funding. Private equity company C9 Capital, which is headquartered in Cedar Rapids, Iowa, and is principally headquartered in Salt Lake City, Utah, is the largest shareholder of EquityNet as of the year 2020. Link: https://www.kiva.org/ CrowdRise: CrowdRise’s fundraising model is based upon the notion of making giving back fun [8], which may lead to more people donating and more funds being raised. Gamification and a rewards point system are used by the platform to encourage users to participate in fundraising and donate. Its primary model is donation-based, and the campaign defaults to keep-what-you-raise. Their default "Starter" pricing is to charge the non-profit a 5% platform fee from each donation, plus a payment processing fee (credit card fee) of 2.9% + $0.30 per donation. Donors may choose whether to pay the fee in addition to the amount of their donation or to have the fee subtracted from their donation amount before being delivered. Link: https://www.crunchbase.com/organization/crowdrise Ulule: As creators, citizens, non-profits or enterprises, we all increasingly share the same goal of taking action to build a better world: one that is more varied, more sustainable and open to everyone. But how can one convert a concept into reality? Ulule helps creators take the jump and, more importantly, convert it into a success! Besides the financial component, Ulule helps its creators throughout this process by helping them make their ideas a reality, co-create with their communities, spread the word about their businesses and make them flourish. Since its founding in 2010, Ulule has been at the forefront of the crowdfunding industry, emerging as the foremost community-supported incubator of initiatives with a good social impact. Our community of over 3 million people has been responsible for bringing 30,000 initiatives to fruition. Ulule is a community and a platform that are accessible to anyone and everyone, especially artists, regardless of their size or skill Link :https://www.ulule.com/ What is Stratics Networks

Ringless voicemail and unlimited drops of ringless voicemail were both invented in the United States by Stratic Networks. The world's leading supplier of unlimited bulk SMS messaging, sophisticated IVR polling, voice broadcasts, interactive voice response (IVR), and online surveys. With Stratics Networks, you may send voice broadcasts or drop an unlimited number of ring less messages. Michael Curri, who is now the company's President and Founder, has been a firm believer in the power of broadband Internet access to improve people's lives, businesses' ability to compete, and the vitality of communities since the company was founded in 1998. Full Footprint: When they Play, Stratics networks uses the entire deck of cards. We make it possible for you to contact any location you choose throughout the United States and North America. As opposed to "the other guys," we do not restrict access to high-cost locations. We offer delivery that is assured to all of the people on your contact list. (Remember to always use a working caller ID). We are able to facilitate the distribution of an SMS message to high-cost locations for your marketing campaign or any other communication. We don't limit access to any parts of the lower 48 states or Canada. When utilized in a responsible manner, all of Stratic Networks' products are entirely legal and in compliance with applicable regulations. The usage of telecommunications can be done correctly or incorrectly, depending on the situation. Allow us to assist you in maintaining compliance and staying on the correct track. Stratics Networks is a responsible usage firm that does not accept any type of spam in any of its services. When you use our products, you must follow all rules and regulations to the letter. Voicemail Drop: At its most fundamental level, voicemail dropping, also known as a pre-recorded voicemail, refers to the act of actually "dropping" a pre-recorded message into the voicemail inbox of another person. Even when they don't hear their phone ring, a notice indicating they have a new message is still sent to them. Inventor of Voicemail Drop: The true first inventor of voice mail, patent number 4,124,773 (Audio Storage and Distribution System), is Robin Elkins. Founder of the VoiceMail System. Gordon Matthews pioneered voice mail in the 1970s, a technology that is now used by roughly 80% of large American corporations. On Saturday, Matthews passed away in a hospital in Dallas, Texas. He was 65 years old and called Austin, Texas, home. After several types of telephone answering machines were developed in the 1920s and 1930s, voice mail had its own humble beginnings in the late 1970s. These beginnings were restricted in scope. During the 1970s, Mr. Matthews developed the idea that would later become known as voice mail in his head. In the year that he submitted his patent application, Voice mail was something that competitors were interested in. Technology, but he is said to have been the first into the workplace. The next year, the first Matthews equipment was bought by the Minnesota Mining and Manufacturing Corporation. Referances:

What is Plaid?

When you connect your bank account to apps managed by financial institutions such as American Express, Venmo, or Upstart, you will most likely contact Plaid. Your financial information is verified and authenticated by Plaid, which enables businesses to send sensitive information safely. The software offered by Plaid acts as a go-between for your bank or credit card accounts and the mobile applications offered by other financial institutions. One example would be a website for managing portfolios, such as Personal Capital, or an app for managing finances, such as Mint. For websites like this to function correctly, they must access your account information. It's understandable if you're apprehensive about giving private information about your finances to a different organization. Here is when the plaid pattern comes into play. Plaid is an intermediary that you use so that you don't have to give all of your bank login information to Mint or Personal Capital. At the moment, Plaid can link with a wide range of critical financial institutions and credit card firms, including Bank of America, Wells Fargo, American Express, and U.S. Bank. How does the Plaid system function? You might, for instance, use Plaid to connect to the bank or credit card account you have with Chime. You will be asked with a window from Plaid whenever you need to pass the credentials for your bank account to another financial app. You will then be able to submit the form after entering your Chime login and password. This information is not shared with any third parties and is only kept by Plaid, who will then call Chime to verify your login credentials. If you have implemented two-factor authentication (2FA), you will also be required to enter that information. If your bank does not allow this additional degree of security, Plaid also provides the option to utilize its two-factor authentication (2FA). According to the company's website, Plaid possesses certifications in internationally recognized security standards such as SSAE18 SOC2 compliance and ISO 27001 and ISO 27701 certifications. After you have authenticated your bank information using Plaid, the link will be established. It will then be possible to utilize it to transfer the financial information you have authorized. This information can include a record of previous transactions, a balance, or anything else. One of the finance companies, Sezzle, which offers an installment payment platform, recently announced that it would be adopting Plaid for financial authorization. Due to the partnership, customers of Sezzle will be able to link their Plaid accounts to their respective financial accounts. Because of this, they will be able to make payments through the Automated Clearing House (ACH), a more time- and cost-effective method than using a credit or debit card. What Is Plaid? The software, known as Plaid, acts as a conduit between the websites you use for your financial transactions and the information you want those websites to get. Utilizing a service such as Plaid can prevent financial websites from gaining access to all of your banking and other sensitive information. Instead, you will only disclose the particular pieces of information that you have indicated. How exactly does Plaid do its job? Numerous financial institutions operate under the justification that they need access to sure of their customers' financial details. This may include a portfolio aggregator that requires access to your investments or a budgeting website that requires access to your bank and credit card activity. Using Plaid, these websites can obtain this information without receiving your bank or credit card login details directly from you. Is There Safety in Plaid? Plaid uses some of the most advanced encryption technologies when transmitting your financial data. The Advanced Encryption Standard (AES 256) and Transport Layer Security are included in this (TLS). Plaid also employs a method known as multifactor authentication (MFA), which provides an additional layer of protection for the transmission of your financial data. Why is it that my Chase account is no longer linked to Plaid? Plaid was able to link to Chase accounts in the past. However, the bank is no longer listed as a supported institution on its website. The termination of Plaid's relationship with Chase has not been addressed in any public statement. Why is it that my Chase account is no longer linked to Plaid? Plaid was able to link to Chase accounts in the past. However, the bank is no longer listed as a supported institution on its website. The termination of Plaid's relationship with Chase has not been addressed in any public statement. What is Decision Logic? The Decision Logic software was created as an enhanced bank verification system that would allow lenders to rapidly check financial information in the fight against fake bank statements, which have become a significant concern and are more common in the commercial lending market. It was created during the financial crisis of 2008, which was partly brought on by a relaxation of the requirements for approving house mortgages. At the time, many applicants submitted fabricated documents to obtain approvals for mortgages they were ineligible for. Many people acquired mortgages that were above their means because there was insufficient technology to verify whether the banking information provided during the qualification procedure was accurate or not. Families were stuck paying a mortgage they couldn't afford, and the ensuing housing bubble led to many of them losing their houses. The corporate world was affected by the expansion of the financial technology markets. For bank verifications, decision logic has emerged as the industry standard. How exactly does one make use of the Decision Logic service? If you are in the process of applying for a business loan or line of credit, you may be wondering precisely what the service will do to access and retrieve your information. This is a natural question to ask in this situation. If you are a lender, you may be curious about how you may use Decision Logic to simplify the information retrieval process. An explanation of each stage is as follows: Step 1: Send a link Before finalizing an application for a business loan or advance, the lender will send the applicant or business owner an email or text message containing a particular Decision Logic link. The applicant or business owner will then view this link. Step 2: The Client Agrees to Participate. After that, the Applicant Enters Their Financial Information. Remember that you can only click on this link once; after that, you won't be able to use it again even if you try. This link can only be used once. Step 3: Opt-in successful. After inputting the information, the opt-in is considered successful, and the verification procedure is finished. After that, the customer will get a signal that their application was successful, and they will be automatically transferred to the lender's website. Bear in mind that as an additional layer of safety precaution, that link will become invalid and cease to function if the applicant does not enter their information within a predetermined amount of time. In addition, neither Decision Logic nor the lender will have access to the information or the strictly up-to-date business statements; only the underwriters would have this privilege. Step 4: View bank statement Now that the lender can access the applicant's bank statements, they can examine those documents to verify their identity. This enables the lender to connect via API and helps speed up the process of funding the business. The lender will receive a statement that is a read-only version of the applicant's business bank statements. This statement will only be used for the one purpose of assisting in the approval process. And that brings us to the end of our discussion! The beginning of the process and its conclusion can be accomplished in minutes. The practice of funding a project or venture by raising money from a large number of people who each contribute a relatively small amount, typically via the internet. This modern crowdfunding model is generally based on three types of actors – the project initiator who proposes the idea or project be funded, individuals or groups who support the idea, and a moderating organization (the "platform") that bring the parties together to launch the idea. Crowdfunding has been used to fund a wide range of for-profit, entrepreneurial ventures such as artistic and creative projects, medical expenses, travel, and community-oriented social entrepreneurship projects. Though crowdfunding has been suggested to be highly linked to sustainability, empirical validation has shown that sustainability plays only a fractional role in crowdfunding. Its use has also been criticized for funding quackery, incredibly costly, and fraudulent cancer treatments. Types: The Crowdfunding Centre's May 2014 report identified two primary types of crowdfunding. Rewards crowdfunding Entrepreneurs pre-sell a product or service to launch a business concept without incurring debt or sacrificing equity/shares. Equity crowdfunding The backer receives shares of a company, usually in its early stages, in exchange for the money pledged. Companies that Offer Crowdfunding Platforms

Following are the platforms which offer to crowdfund

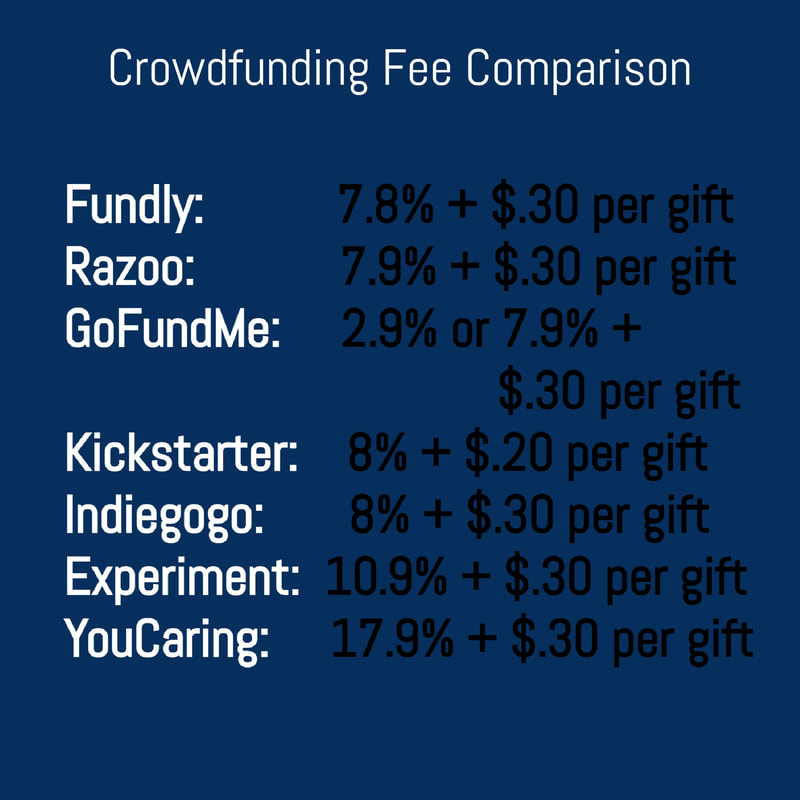

How Much Do Crowdfunding Sites Charge? Different crowdfunding sites charge different amounts. Make sure to read about all of the fees charged by the site before signing up. Sites will typically charge a fee for processing payments, ranging from 3% to 5% per transaction or a percentage of monthly income earned. Some sites might also require that a minimum amount be raised, or else the contributors get their money back, so make sure you'll be able to hit your target. Which Crowdfunding Platforms Would Be Best?

How We Chose the Best Crowdfunding Sites We reviewed the most popular crowdfunding sites to narrow them down to our top picks. We selected the best crowdfunding sites based on their features, track records, number of users, type of crowdfunding they offer, costs, and more. There are ways that companies trying to get crowdfunding can advertise their opportunity to investors. Marketing channels play a vital role in implementing the organizational strategy. Inbound and outbound marketing are based on different methods. Inbound marketing uses blogs, webinars, socials, and paid ads to promote the product/service to a vast audience. Outbound methods include TV/radio, cold-calling, events, and email marketing. For the crowdfunding niche, inbound marketing channels work better; however, emailing is also an excellent way to build the client base.

What is Decision logic? The Decision logic software was developed as an advanced bank verification system that would allow lenders to verify financial information to fight against fraudulent bank statements instantly. This problem has been getting worse and more common in the business lending space. Decision logic is the most secure bank verification technology developed to date. After reading, we hope you have a better idea of how crucial the Decision Logic program is in establishing a more secure lending climate in the American economy following the subprime crisis. Developer David Evans, the CTO and President of Decision Logic, has over 25 years of experience as a Chief Technology Officer and has served in various roles, including serving as a Scientific Adviser to the UK Government. CEO Carl Fredericks, a former Vice President of an IBM partner and account manager for numerous governments, industrial, and financial institutions, also contributed to the company's development. Purpose The Decision Logic software was created as an enhanced bank verification system that would allow lenders to rapidly check financial information in the fight against fake bank statements, which have become a significant concern and are more common in the commercial lending market. If you are a lender, you may ask precisely how Decision Logic might be used to speed up the information retrieval procedure. Here is an explanation of each action:

Step 1: Custom Decision Logic Before finishing a business loan or advance application, the lender provides the applicant/company owner a custom Decision Logic link via text SMS message or email, which they access. Step 2: Customer opts-in The applicant then enters their banking details. Remember that you can only visit this URL once; once it has been used, it cannot be accessed. Step 3: Opt-in successfully. The opt-in is booming, and the verification procedure is finished after the information has been entered. The customer is instantly forwarded to the lender's website after receiving a success notification. The applicant must input their information within a set amount of time, after which the link expires and ceases to function as an additional security measure. Neither Decision Logic nor the lender will access the data; only underwriters will, together with rigorously up-to-date business statements. Step 4: View bank statement Now that the lender can access the applicant's bank records, they can check them for authenticity. This speeds up the funding process and enables the lender to connect via API. A read-only copy of the applicant's business bank statements is provided to the lender to aid in deciding on approval. That's all there is to it! The entire process can be begun and finished in just a few minutes. Services: Using our service, lenders can instantly confirm a borrower's identity, account number, and balance. Additionally, it gives users access to the past 365 days' transactions from the borrower's account. Many of the issues with traditional ways of loan decision-making are eliminated by this computerized real-time approach. IAV enables lenders to take quick, precise actions essential to their business's success. Solutions for Leading Industries Where Transaction History Assessment in Real-Time is Critical.

Why Do Banks and Finance Companies Use Decision Logic? For bank verifications, decision logic has emerged as the industry standard. Decision Logic allows lenders to quickly evaluate acceptable bank information, enabling them to make wise lending decisions. This technique benefits both the lender and the borrower because it prevents the latter from taking on a loan they cannot afford. The Instant Account Verification (IAV) solution from Decision Logic was created for the financial sector to help its clients make loan choices faster and more accurately. They have teamed up with the top global credit and financial data providers to establish a unique Data Provider Aggregation Environment. Decision Logic has developed a cutting-edge, user-friendly, effective, and secure solution using the most recent technology from these data providers. Currently Serving

According to the most recent information that the IRS has released, applicants who have already submitted their tax returns can anticipate receiving their refunds anywhere from six to ten months after the date on which the returns were submitted. Many services that provides employee retention credit will charge a commission once the money has been accepted and sent to your company. The Employee Retention Tax Credit is currently the most extensive government stimulus program in the annual economic history, which is a positive aspect. There is a possibility that your company might be awarded a grant of up to $26,000 for each employee. How long do you have to submit a claim to receive the credit for retaining employees? If your company recovered from a significant drop in gross receipts, but did not submit an application for the credit, you are eligible to do so in 2022. To assess whether or not they are eligible for the program, businesses have three years after it comes to an end to look back on wages earned after March 12, 2020. Credit Services That Are Best for Keeping Employees

ERC Assistant ERC Assistant is a service that helps companies save money on employee retention credits by streamlining the process of onboarding new clients and reporting claims in as little as one to two weeks. Additionally, ERC Assistant protects sensitive information with its private and password-protected Client Portal. An initial ERC estimate can be obtained at no cost and with only a tiny amount of effort paid up front in the process. Lastly, the ERC Assistant team can provide paperwork ready to be filed with the IRS without contacting your payroll provider. ERC Today ERC Today is a service that helps companies evaluate their eligibility for employee retention credits. The service also completes a comprehensive analysis of the claim, provides guidance on the claiming process and documentation, offers specific program expertise that a regular CPA or payroll processor may not be well-versed in, and ensures that the entire process, from eligibility to claiming and receiving refunds, is carried out quickly and smoothly. ERC Today Purpose: The purpose of ERC Today is to evaluate how the PPP loan will be included in your ERC, the differences between the 2020 and 2021 programs, and how they relate to your company. We will also discuss the aggregation rules that apply to larger employers that operate in multiple states and how you should interpret executive orders from multiple states. Contact details

|

Cox Business News staff WriterJournalists from around the world writing to give you answers, with Assitant Editor Dr Muhammad Hassan Fayyaz for articles in June and July 2021 The Editor In Chief of Cox Business News

|

RSS Feed

RSS Feed