|

Crowdfunding: The process of obtaining financial support for a venture or project by soliciting contributions from a large number of individuals, most frequently through the use of the internet in today’s modern times, is known as crowdsourcing or crowdfunding. Crowdsourcing and alternative finance are two other names for the practice of crowdfunding. In 2015, crowdfunding campaigns successfully raised more than $34 billion USD all over the world. "Crowdfunding" refers to registries that are run through the internet, but similar ideas can also be used through mail-order subscriptions, benefit events, and other means. The modern model of crowdfunding is generally based on three different types of actors, including the project initiator, who proposes the idea or project to be funded; individuals or groups who support the idea; and a moderating organization (the "platform") that brings the parties together to launch the idea. A diverse array of for-profit entrepreneurial endeavors, including artistic and creative projects, medical expenses, travel, and community-oriented social entrepreneurship projects, have been funded through the use of crowdsourcing. Despite the fact that it has been hypothesized that crowdfunding has strong ties to environmentally friendly practices, empirical validation has demonstrated that environmental friendliness plays only a minor role in crowdfunding. Its utilization has also been criticized for the funding of quackery, particularly expensive and questionable cancer treatments. The platforms listed below provide crowdfunding services.

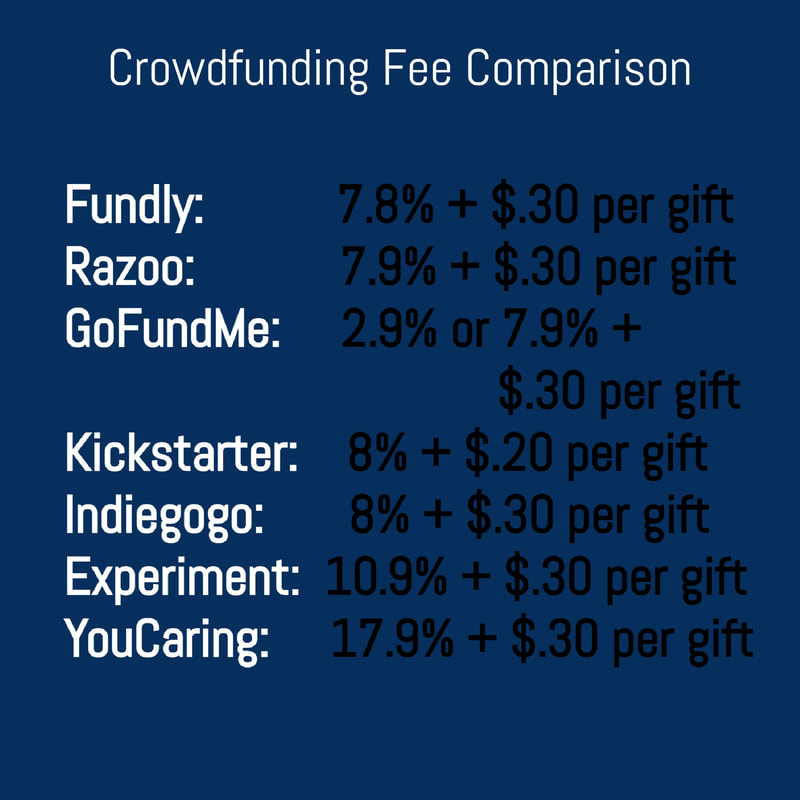

Indiegogo Indiegogo is a website based in the United States that facilitates crowdsourcing and was established in 2008 by Danae Ringelmann, Slava Rubin, and Eric Schell. San Francisco, in the state of California, serves as the organization’s headquarters. The website was one of the first to provide crowd funding, making it a pioneer in the field. People are able to request financial support for an idea, a charity, or a new business venture via Indiegogo. Indiegogo deducts a fee of 5% from each contribution made. These fees are in addition to the standard credit card processing fees levied by Stripe, which are 3% plus $0.30 per transaction. Every single month, the website is seen by over fifteen million individuals. The website uses a system that is based on rewards, which means that donors, investors, or customers who are willing to help fund a project or product can donate and receive a gift rather than an equity stake in the company. This is because the system the website uses is based on a rewards-based model. Indiegogo has teamed up with Micro Ventures to offer equity-based campaigns starting in November 2016. This is in response to rule changes made by the Securities and Exchange Commission earlier in 2016.This will enable unaccredited investors to participate in campaigns involving equity stakes. In 2014, Indiegogo introduced a new tool called Indiegogo Life, which allows users to raise money for a variety of life-related causes, including crises, medical costs, celebrations, and other life events. There was no platform fee associated with Indiegogo Life campaigns Link: https://www.indiegogo.com/ Campaign rules Users who are between the ages of 13 and 17 are not permitted to use the website without the permission of a parent or legal guardian. The owners of campaigns are not allowed to develop campaigns that try to gather money for actions that are against the law, that are obviously fabricated, or that pretend to do something that is not achievable. If the campaign is going to give benefits, it cannot offer any cash inducement, any sort of stake in the firm or enterprise, or any other type of interest. The campaign is not permitted to provide any kind of lottery or gambling, as well as alcohol, drugs, guns, or ammunition of any kind. A campaign is not allowed to spread ideas or opportunities that might result in physical harm, loss of life, destruction of property, or any other act that infringes on the rights of another individual in any way that can be communicated. Kickstarter Kickstarter is a global crowdfunding site with its headquarters in Brooklyn, New York, and it places a strong emphasis on creative projects. Kickstarter is an American public benefit corporation. The purpose of the organization is described as being to "assist in bringing creative ventures to reality." As of July 2021, Kickstarter has collected $6.6 billion in pledges from 21 million supporters for the purpose of funding 222,000 projects. These projects included things like films, music, stage events, comics, journalism, video games, technology, publishing, and food-related endeavors. In exchange for their financial support, backers of projects on Kickstarter are often given access to unique experiences or physical goods. This technique may be traced back to the subscription form of art patronage, in which artists would approach their audiences directly to ask for financial support for their work. The entire amount of funds raised is subject to a charge that is equal to 5% of the total amount. An extra cost of between 3 and 5% is applied by their payment processor. In contrast to many other online communities that facilitate fundraising or investment, Kickstarter does not assert any ownership over the projects that its users create or the work that they produce. The website pages of projects that were started on this site are archived indefinitely and made available to the general public. Once the funding goal has been reached, the projects and any uploaded media can no longer be edited or removed from the site. Categories The creators of each project place it into one of the 13 main categories and one of the 36 subcategories. These include the fields of art, comics, dance, design, fashion, food, games, music, photography, publishing, technology, and theater. Film and video and music are the two most popular categories; as seen by the amount of money they have brought in between them. Together with the Games category, this group accounts for more than half of the total funds raised. The combined total of video games and tabletop games accounts for more than $2 of every $10 that is pledged to projects on Kickstarter. Guidelines Kickstarter has outlined three guidelines for all project creators to follow in order to maintain its focus as a funding platform for creative projects. Creators can only fund projects; projects must fit within one of the site’s 13 creative categories; and creators must abide by the site’s prohibited uses, which include charity and awareness campaigns. Hardware and product design projects submitted to Kickstarter must adhere to some extra standards. The following are examples:

Link: https://www.kickstarter.com/ GoFundMe During this round of the process, participants have the opportunity to provide a description of the reason they are raising money, the amount they are hoping to collect, and to add images or videos. Once the website has been constructed, GoFundMe enables users to share their project with others by integrating connections to social networking sites such as Facebook, Twitter, and others, as well as providing email sharing options. Donations to a user’s cause may then be made on the website using a debit card or credit card , and the user can monitor how much money has been raised. People who donate money are given the opportunity to submit feedback on the website. In the event that the user does not receive any donations, there will be no fee paid. [14] Each transaction made on GoFundMe is subject to a 2.9% processing fee as well as a $0.30 fee. Link; https://www.gofundme.com/ Fundable Fundable founders Wil Schroter and Eric Corl established Fundable on May 22, 2012, and the day was chosen as the launch date. There is no connection between the current business and the crowdfunding website that operated under the same name and at the same website address from 2005 to 2009. Its origins may be traced back to a system that was centered on incentives. Backers make monetary contributions to fledgling firms in exchange for perks or for the opportunity to place advance orders for the products that the companies plan to manufacture following the conclusion of the campaign. A platform that is built on equity, which went live in August of 2012. After the JOBS Act was passed and signed into law by President Barack Obama in early 2012, Fundable was one of the first equity crowdfunding portals to be established in the United States. At this time, only qualified investors who have a minimum net worth of one million dollars are eligible to participate in businesses using the equity side of the platform. The company requires all prospective clients to pay an upfront monthly fee beginning at $179, regardless of the result of their application. Fundable is able to function thanks to the assistance and financial backing of Virtucon Ventures, an investment business located in Columbus, Ohio, that is the only investor in the company. In addition to that, it is supported by a select group of business consultants, one of which is Mark Nager, the CEO of Startup Weekend. Link: https://www.fundable.com/Fundable LLC Wefunder Wefunder was founded on the principle that each individual, regardless of their financial situation, ought to be able to invest in a business. At the right moment, only accredited investors are legally allowed to put money into new businesses, and each of these investors needs to put up a minimum of $1,000 in order to have a stake in the company. Once the complete deregulatory changes that were promised by the JOBS Act are implemented, the firm has plans to reduce the minimum investment required to become an investor to $100. According to Tommarello, "filling the financial gap between angel investors and that first large round of money" is the mission of We Funder. Link: https://wefunder.com/ StartEngine StartEngine generates revenue through the collection of fees from issuers, or the business that is selling shares. As a result, the vast majority of our offerings do not cost an investor a single cent. Having said that, issuers have the option of offsetting the expenses by requiring investors to pay a charge of 3.5%. In addition to the cost of the share itself, investors will be required to pay this fee. As a processing fee, your total amount charged and the number of shares you will get will be clearly mentioned on the investment form. There are no additional costs associated with investing, whether you make your payment by an ACH transfer or a credit or debit card. There is a possibility that your bank will assess additional costs in connection with the wire transfer of funds if you choose to make your payment using that method. If you intend to conduct a wire transfer, it is imperative that you inquire with your financial institution about the associated expenses as soon as possible. This will allow you to prepare for and pay for any necessary extra transfer fee Link; https://www.startengine.com/ RocketHub RocketHub makes it possible to engage directly with fans through social media and raise money for causes. Project leaders, also known as fundraisers, are responsible for their own public relations and publicity through social media platforms such as Facebook and Twitter. Users specify a campaign timeframe, a target funding goal, and the "perks" they will give in exchange for donations when they publish a campaign on the platform. In a general sense, RocketHub is comparable to sites such as Kickstarter, Sellaband, and Pledgemusic. On the other hand, even if the specified fundraising goal is not met by the deadline, the project leader is still allowed to keep the money that has been gathered for the campaign. If the project meets its funding goal, RocketHub takes 8% of the total amount collected in addition to the 4% payment processing fee. Link: https://www.crunchbase.com/organization/rockethub CircleUp CircleUp is a San Francisco-based financial technology company that mostly works with new businesses in the consumer products industry. Since its formal launch in April 2012, CircleUp has assisted a number of consumer firms in raising equity funding. Some of these companies include Back to the Roots, Halo Top Creamery, Little Duck Organics, and Rhythm Superfoods, as well as a few more. General Mills has an investment fund, and they have partnered with CircleUp so that they can invest in other companies that are listed on CircleUp. CircleUp’s equivalent of an exchange-traded fund (ETF) for early-stage private marketplaces is called the Marketplace Index Fund. The minimum amount that may be invested in the fund is $25,000.https://circleup.com/ Link; FundRazr FundRazr employs the donation/perks crowdsourcing model, which is available for usage by organizations, charities, and personal causes. There are three price levels available for FundRazr: free (a platform charge of 0%), standard (a platform fee of 5% for expanded features), and pro (fee recovery models). If no funds are raised, there will not be a charge for the service. Users have the ability to set up a campaign page exclusive to their cause on FundRazr. The page can then be sent to supporters via social media, emailed to them, or embedded onto a website that is not affiliated with the cause in order to request money. Facebook users may publicly demonstrate their support for a cause by leaving comments, sharing content, giving likes and hearts, and donating money. Users are able to deposit and receive funds via PayPal thanks to FundRazr’s connection with the online payment service. Keep It All and All Or Nothing are the two campaign options that users of the fundraising platform have at their disposal in order to raise money. When a user selects the Keep It All option, it indicates that the total amount of money received by the campaign will be put into the user’s account, providing the user with immediate access to the cash. If the campaign does not accomplish its objective by the specified time, then the contributors will not be charged and the user will not get any funds as a reward. This is the "All Or Nothing" model. In other words, the user always has the option to withdraw from the campaign if it does not succeed in raising enough money to get the project off the ground. Microventures MicroVentures is a platform that facilitates equity crowdfunding and offers investments in startups in their early stages. MicroVentures facilitates connections between authorized investors and start-ups, enterprises, and services that want to raise capital or take part in certain secondary market possibilities. It is the only major crowdfunding platform that also functions as a broker-dealer and is registered with the Financial Industry Regulatory Authority (FINRA) and the first to successfully lead an investment portfolio firm to a profitable exit. As of the month of October 2013, MicroVentures had successfully raised a total of twenty million dollars from forty-five different companies, including Twitter, Facebook, and Yelp (before they reached the public markets). listing of companies and conducting research on them. MicroVentures provides funding for new businesses in a variety of sectors, including

Link : https://microventures.com/ CrowdSupply: Crowd Supply is an online platform for crowdsourcing that is headquartered in Portland, Oregon. The site claims to have "almost double the success rate of Kickstarter and Indiegogo" and collaborates with creators who utilize it to provide mentorship similar to that of a business incubator. So far, the platform has raised over $1 million. Some people believe that the meticulous project management that Crowd Supply provides is the answer to the high proportion of failed fulfillment attempts that other crowdfunding platforms experience. Additionally, it functions as an online store where the inventory of winning campaigns may be purchased. Andrew Huang’s open-source laptop design, Novena, is one of the most notable initiatives to come from this platform Fundly: The online fundraising platform Fundly is referred to as "crowdfunding." It makes it possible for organizations that are not-for-profit, charities, political campaigns, clubs, schools, teams, and churches, as well as other causes, to raise money online from friends, family, colleagues, donors, and other supporters by using email, Facebook, Twitter, LinkedIn, Google, and other social media networks. Additionally, it is an application for use on social networks such as Facebook and LinkedIn. Donations are processed through the use of WePay. When they make a gift, donors are expected to pay a fee. Other sites similar to Fundly include GoGetFunding, Indiegogo, and Kickstarter. The amount of money raised determines the fee that must be paid to use Fundly. Individual campaigns are assessed a fee equal to 4.9% of the cash received, in addition to credit card processing fees of 3%. When a campaign reaches a specific donation threshold, Fundly will reduce the proportion of the fee that it charges for using the platform. Contributions to campaigns that raise between $50,000 and $500,000 are subject to a 4.4% fee, donations that raise between $500,000 and $1,000,000 are subject to a 3.9% fee, and donations that raise above $1,000,000 are subject to a 2.9% fee. Link: http://fundly.com/ Kiva : Kiva is a debt crowdfunding platform that is available to any small business in the United States. The catch is that there is no interest, and the amount that can be borrowed is typically no more than $10,000. To be eligible for funding through Kiva, you will need to plan a campaign and collaborate with a Kiva representative; however, your credit will not be checked. Instead, it uses the approval of your contemporaries as the basis for determining your creditworthiness. Since the company’s inception, it has provided more than $1.25 billion in loans to customers all over the world. EquityNet: Since 2005, EquityNet has been running one of the most successful and comprehensive platforms for business crowdfunding. To plan, analyze, and raise capital for privately held businesses, members of the entrepreneurial community utilize the multi-patented EquityNet platform. This platform is used by thousands of individual entrepreneurs and investors, as well as incubators, government entities, and other members of the entrepreneurial community. Entrepreneurs all around North America have been able to generate more than $500 million in equity, debt, and royalty-based finance with the assistance of EquityNet, which gives access to thousands of investors. Because the firm is not a registered broker-dealer, it does not participate in the process of moving money from one account to another. Following the decision made by the United States Securities and Exchange Commission on September 23, 2013, to lift the ban on general solicitation, EquityNet granted permission to businesses using its platform to make use of the new rule established by the SEC and publicly advertise the fact that they are in need of funding. Private equity company C9 Capital, which is headquartered in Cedar Rapids, Iowa, and is principally headquartered in Salt Lake City, Utah, is the largest shareholder of EquityNet as of the year 2020. Link: https://www.kiva.org/ CrowdRise: CrowdRise’s fundraising model is based upon the notion of making giving back fun [8], which may lead to more people donating and more funds being raised. Gamification and a rewards point system are used by the platform to encourage users to participate in fundraising and donate. Its primary model is donation-based, and the campaign defaults to keep-what-you-raise. Their default "Starter" pricing is to charge the non-profit a 5% platform fee from each donation, plus a payment processing fee (credit card fee) of 2.9% + $0.30 per donation. Donors may choose whether to pay the fee in addition to the amount of their donation or to have the fee subtracted from their donation amount before being delivered. Link: https://www.crunchbase.com/organization/crowdrise Ulule: As creators, citizens, non-profits or enterprises, we all increasingly share the same goal of taking action to build a better world: one that is more varied, more sustainable and open to everyone. But how can one convert a concept into reality? Ulule helps creators take the jump and, more importantly, convert it into a success! Besides the financial component, Ulule helps its creators throughout this process by helping them make their ideas a reality, co-create with their communities, spread the word about their businesses and make them flourish. Since its founding in 2010, Ulule has been at the forefront of the crowdfunding industry, emerging as the foremost community-supported incubator of initiatives with a good social impact. Our community of over 3 million people has been responsible for bringing 30,000 initiatives to fruition. Ulule is a community and a platform that are accessible to anyone and everyone, especially artists, regardless of their size or skill Link :https://www.ulule.com/

0 Comments

Leave a Reply. |

Cox Business News staff WriterJournalists from around the world writing to give you answers, with Assitant Editor Dr Muhammad Hassan Fayyaz for articles in June and July 2021 The Editor In Chief of Cox Business News

|

RSS Feed

RSS Feed